All About Common Myths in 2022 About the Employee Retention Credit

Is the Employee Retention Tax Credit (ERTC) an Option for Your Business? - PBO Advisory Group

Not known Facts About Commissioner to Congress: IRS will clear backlog by year's end

"Although the program is set to sunset at the end of 2021, the credit can be claimed on modified payroll tax returns as long as the statute of constraints remains open, which is three years from the date of filing," said Brent Johnson, co-founder and CEO of Clarus R+D, a maker of software application for declaring tax credits.

9-12 in Las Vegas and practically.] ERTC Essentials, The ERTC, also referred to as the Employee Retention Credit (ERC), was produced by the Coronavirus Aid, Relief and Economic Security (CARES) Act, signed into law in March 2020, to motivate businesses to keep workers on their payroll. The Consolidated Appropriations Act, 2021 (CAA), enacted in December 2020, and the American Rescue Plan Act (ARPA), enacted in March 2021, changed and extended the credit and the accessibility of specific advance payments of the credits through completion of 2021.

The credit uses to wages paid or sustained from March 13, 2020 through Dec. 31, 2021. The expense of employer-paid health benefits can be considered part of employees' qualified salaries. Qualified Services, There is no size limit on eligibility for the ERTC. Nevertheless, small and large organizations are treated in a different way, Fried noted: all employee incomes receive the credit, whether the employer is open for company or topic to a shutdown order.

ERTC - World Refining Association

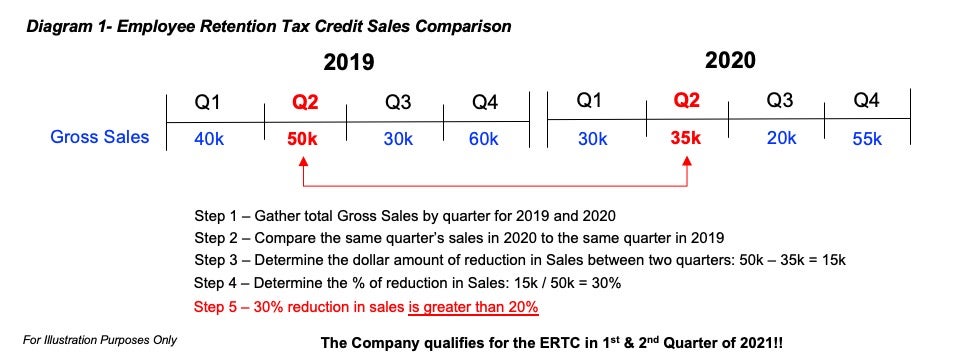

Qualified companies are private-sector services and tax-exempt companies that experienced: as a result of a federal government order restricting commerce due to COVID-19 throughout 2020 or 2021. during a 2020 or 2021 calendar quarter, when compared to the very same quarter in the prior year. that was introduced after Feb. 15, 2020, for which the average yearly gross invoices do not exceed $1 million, based on a quarterly ERTC cap of $50,000.

Some Known Incorrect Statements About Employee Retention Tax Credit - Severely Financially Distressed

For 2021, a service must have experienced more than 20 percent decrease in gross invoices, compared to the same quarterly duration of 2019. New organizations not out there during a specific quarter in 2019 are allowed to substitute the matching quarter of 2020 for the contrast."If This Is Cool experienced a substantial decrease in gross receipts however has actually considering that recuperated and you didn't declare the credit, you can go back and declare it now," Johnson stated.